The present digital era is powered by mobile devices and social media, where consumers now demand 24×7 banking and other services in real-time. Higher customer expectations, fast-changing payments technology, the complexity of transactions, lower margins, regulatory compliance, and intense competition from FinTech companies, are constant challenges faced by the banking industry. Traditional processes of data handling and legacy IT systems, are no longer sufficient to keep up with the fast pace of change in the financial services sector.

Why Banks Need to Revisit Their Data Policies

- Instances of the banking system being used for fraud and terrorist financing have given rise to regulations spearheaded by global financial bodies like the FATF.

- Stringent money laundering regulations with high penalties of non-compliance have placed further demands of ongoing risk management and compliance systems.

- This involves stringent measures of customer identity verification and validation to be undertaken by banks.

- Failure to comply leads to huge penalties. Some instances in the past where banks were penalised for non-compliance are the HSBC Group ($1.9 billion) and Standard Chartered ($327 million) in 2012, and the Deutsche Bank ($204 million) most recently in November 2017.

- In India, banks like the Punjab National Bank have also been in the limelight for being unable to detect NPAs (non-performing assets) and taking corrective measures to mitigate huge banking losses.

This has driven banks to harness the huge volume of data assets to manage risks of fraud and errors while cutting costs and delivering more value to their customers.

- The banking and finance industry is becoming a highly competitive marketplace with the emergence of financial technology (FinTech) companies using the banking infrastructure for value-added services.

- In this environment of financial convergence where banks partner with financial service companies and e-commerce, banks are faced with the challenge of processing voluminous data across channels.

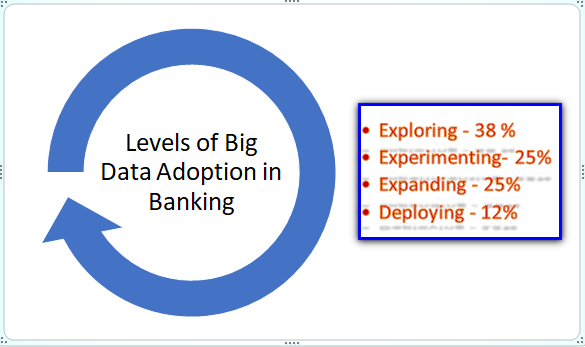

So the banking sector has witnessed an unprecedented digital transformation through the adoption of state-of-the-art technologies, with big data analytics at the core.

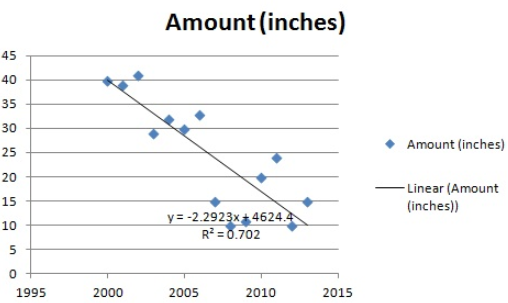

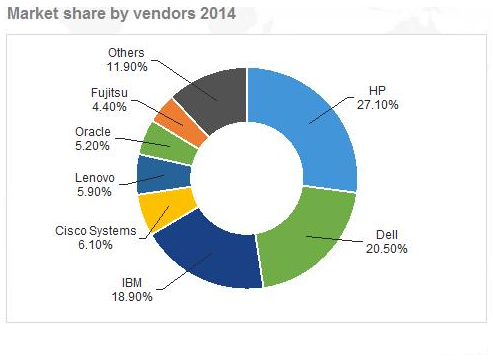

The Big Data Analytics Market in the Banking Industry

According to the Research and Markets Report, the global big data analytics adoption in the banking industry was valued at US$ 7.19 billion in 2017. It is expected to grow at a CAGR of 12.97% during the period 2018-2023 to reach US$ 14.83 million by 2023. Big data analytics applications in banking are finding increased deployment in areas of Fraud Detection and Management, Operation Intelligence, Customer Analytics, Social Media Analytics, and Customer Relationship Management.

What constitutes Big Data in Banking?

- In the banking industry, the amount of data generated is exploding.

- Big data refers to the customer transaction data, data related to banking products like loans and investment services, operational data, as well as the data exchanged between banking institutions and financial partners.

- The data is so humungous that issues like fraud management and customer risk assessment pose a huge challenge for banks.

- However, with real-time high-end streaming analytics in a high-performance computing (HPC) environment, banks are able to find value from the big data.

- Insights gained from the data enable banks to be regulatory compliant, manage fraud and money laundering risks, as well as more banking products, and ensure customer satisfaction.

Customer Data

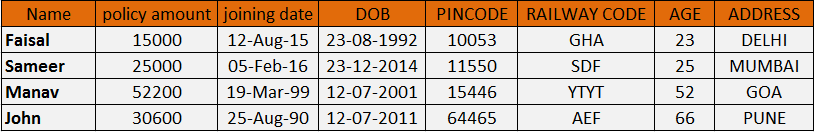

Banks process huge amounts of disparate, multi-channel, multi-device data in real-time. Data related to customers include transaction data, credit card use, new customer onboarding, and due diligence checks, and customer behaviors across various channels of information, like chatbots and social media.

In a customer-driven marketplace, CEOs are faced with a number of challenges – gaining a 360-degree view of the customer, widening customer outreach across ever-increasing channels and countless marketing campaigns, while proving an effective Return on Marketing Investment (ROMI). With marketing strategies powered by data-driven insights, marketing managers are able to monetize the available data to achieve sales targets and enhance customer relationships.

Operational Data

Like every other business or institution, banks have their internal data related to marketing targets, controls, bank workforce, suppliers, accounting data, and more. This operational data is core to reporting requirements, internal checks, the decision-support system of the bank, and optimal resource use.

Financial Data

Banks are profitable ventures that keep tight control on financial metrics, as their balance sheet governs shareholder confidence, brand image, and industry ranking. All this is with the goal of financial data related to its operations, incomes, legal expenses, and financial liabilities is maintained with due diligence.

Market data

Banks collect data on the economy, social statistics, political trends, technological advances, stock markets, and financial market trends. They also collate strategic data surrounding the industry, which includes updates in the regulatory landscape, industry practices, and data on competitors and their products.

Risk assessment data

One of the key areas of banking operations is risk assessment. Risk data includes the entire spectrum of risk profile building, automated testing, analysis, and validation of controls, to name but a few. Analysis of risk data is critical for developing risk scorecards, notification of red flags, creating processes for control remediation, targeting high-risk areas, and making data-driven reports.

Why the Need for Big Data Analytics?

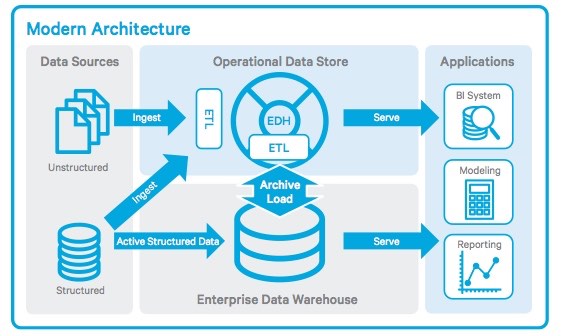

Banks process a “variety” of structured and unstructured data from various devices, mobile apps, social media, markets, transactions, customer behaviour, credit scores, chatbot conversations, risk assessment reports, sanctions screening updates, and so on. As banking processes occur in real-time across the world, the threshold of transactions per second is huge. With data created at high “velocity”, the analytics also needs to be quick for real-time actionable insights. For instance, when there is unusual activity in a customer account, the system needs to analyze the transactions in real-time for actions based on the data-driven insights. The “volume” of data processed is huge and can be up to terabytes of data per day. The genuineness of the data or “veracity” is another aspect of concern. Is the customer KYC data trustworthy? Does it need to be validated using third-party services?

These challenges of big data have given rise to the “value” aspect, which applies big data analytics in real-time for data-driven insights for:

- Fraud management,

- Risk assessment, compliance & reporting,

- Customer service,

- Operational efficiencies,

- Innovative banking products and services,

- Profits.

Faster processing speed is the mainstay of faster analytics and quick decisions. The ability to detect anomalies and risks, or respond to market changes with upsells, can make the difference between huge losses and brand enhancement. Greater operational agility to respond faster to market changes is often the game-changer, with the capacity to save billions and ensure timely regulatory compliance. So banks are now transforming the vast data assets at their disposal into “valuable” insights at every level of data maturity. These insights hold the key to business success in a high-performing data-driven landscape.

The banking industry is part of the fiercely competitive financial sector. By using a data-driven approach, banks are able to deliver innovations in payments and services, enable instant detection of anomalous patterns in customer transactional data or suspicious internal data manipulation; for a higher ROI. Big data analytics powers the seamless and robust performance of a bank for a business edge.

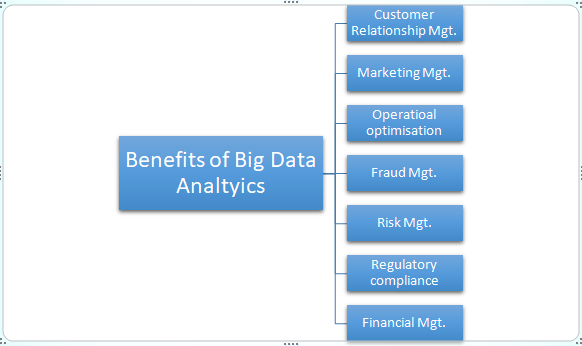

How Big Data Analytics Is Powering the Banking Industry

Big data is at the core of digital transformation in banking, defining how banks deliver value to the customers while remaining compliant with the laws. Increased customer confidence, expansion of banking operations, maximizing ROI on marketing investments, and mitigating risks, are some chief banking objectives. The enabler for the key goals of banking is analytics.

With banks keen to leverage big data analytics, the stakeholders are asking the question: “How can this data help us solve our business problems?”

While customer analytics is the key to outperforming competition across the full customer lifecycle, operational and risk analytics are also helping banks achieve operational efficiencies and reduce risks.

CUSTOMER RELATIONSHIP MANAGEMENT

Below, you can see how big data analytics help with customer relationship management.

Higher customer satisfaction (CSAT)

The huge datasets are fused together for a single 360-degree view of the customer. By tracking a customer’s social behavior and rigorously measuring the feedback, banks can improve and develop their products and services for effective CX. Customer transaction and behavior data are leveraged for an intuitive approach to customer expectations to power personalized service, tailor-made loan and credit card offers, higher CX, and brand loyalty.

Customer retention

Big data is used to develop key metrics and KPIs (Key Performance Indicators) related to customer activity, investments, channels of touchpoints, and more. Predictive analytics is applied to target customer retention campaigns for a bottom-line ROI.

Sentiment analysis of social media activity or customer response also drives loyalty programs, content-driven marketing, and social media techniques for effective CRM (Customer Relationship Management). This significantly reduces customer churn.

MARKETING MANAGEMENT

Customer engagement for longer CLV

Cross-channel data integrated seamlessly into all customer-facing channels, drive insights for longer customer engagement. Based on churn analysis, campaigns and upsells can be tailored to engage customers for longer customer lifecycle value (CLV).

Customer segmentation for tailored marketing campaigns

Customer segmentation helps banks understand their customers on a granular level. The huge customer data available with banks are used for segmentation by customer value, demographics, life stage, behavior, and touchpoints reveal specific intelligence. These data-driven insights, in turn, drive messaging strategies. Segmentation also helps banks better understand the customer lifecycle and predict customer behavior.

However, the real power of customer segmentation lies in the bank’s ability to drill down to the information where the segments overlap. For instance, a micro-segment like ‘Millennials who are starting their own eCommerce businesses’, can prove to be a valuable customer segment for banks to prioritize with customized loan offers.

New customer acquisition

In an increasingly competitive marketplace, banks need to have highly optimized data-driven customer acquisition strategies that capture new customers, as well as track the ROI on your marketing. This is fast-tracked using big data analytics.

Marketing Mix

Using social analytics, sales, and territorial figures, banks are building strategies around social media channels to reach more numbers of potential customers. Based on marketing metrics, banks are also implementing cutting-edge technologies like mobile check deposits and financial calculators, to attract more customers.

OPERATIONAL OPTIMISATION

Operational decisions are high-volume and repetitive in nature. Analytics of data such as contact center, CRM (customer relationship management) and ERP (enterprise resource planning), help optimize operational efficiencies and reduce costs. Operational analytics solutions transform the big data into insights for improved decision-making in near real-time, lower costs, and enhanced service at granular levels. Banks can outperform the competition with in-depth analysis of the performance of key operational areas, such as sales and operations planning. Analytics also builds models related to demand forecasting, inventory management, network optimization, and HR (human resource) operations across the banking infrastructure, including its branches and various departments.

FRAUD MANAGEMENT

Big data analytics used together with other technologies like Machine Learning (ML) and Artificial Intelligence (AI) help differentiate, for instance, unusual customer activity based on the customer’s history, for fraud detection. The analytics systems suggest immediate actions, such as blocking such irregular transactions or informing the customer, to stop fraud before it occurs.

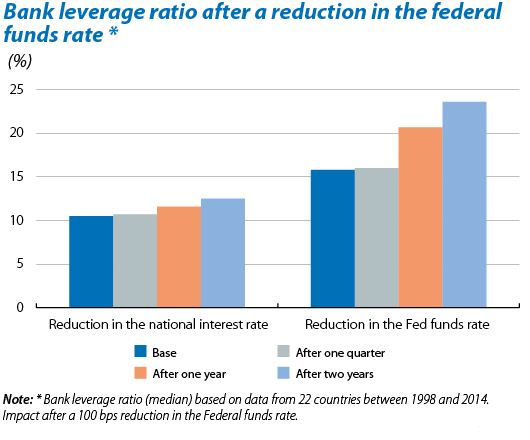

RISK MANAGEMENT

While every business needs to engage in risk management, it is of utmost importance in the financial industry. Regulatory schemes such as Basel III require firms to manage their market liquidity risk through stress testing. Banks need to follow these risk assessment methods, as well as manage their customer risk through analysis of complete customer portfolios. Banks also manage the risks of algorithmic trading through back-testing analysis against historical data. The biggest use case of big data analytics is in supporting real-time alerts if a risk threshold is surpassed.

REGULATORY COMPLIANCE

Financial services firms operate under a heavy regulatory framework, which requires significant levels of monitoring and reporting. Banks have to monitor transactions and documentation in detail, as part of AML/CTF (anti-money laundering/counter-terrorist financing) compliance and trade surveillance. Big data analytics helps identify financial activities that do not conform to regulations or abnormal trading patterns.

FINANCIAL MANAGEMENT

Big data analytics deployed across financial dashboards and statements give a detailed, data-driven view of the financial picture. Financial KPIs help answer specific business questions and to forecast possible scenarios, analyze performance against budgets, real-time monitoring of financial indicators, and so on. This helps bottom-up accountability as well as supports timely decisions based on data-driven insights. Analytics of financial data forms the mainstay of shareholder confidence, budgetary allocations, and HR decisions.

Bottom line

The banking industry is one of the fastest-growing industries that has already integrated big data analytics within its system for a competitive advantage. Due to both regulatory requirements of AML/CTF compliance, and the value of big data analytics, banks will continue to implement more and more big data analytics projects across their operations.