Payments in an organization are a business critical phenomenon that must be processed with high security. Frauds that are a common occurrence in the payment system for any business usually take up a huge amount of time and energy to be identified and sorted.

An estimated 63% of businesses worldwide have experienced some form of online payment processing fraud in the last one year. This is a significant number and is the #1 concern of E-Commerce sites. The online commercial market is global and the volume of frauds has shown a greater incidence in international transactions.

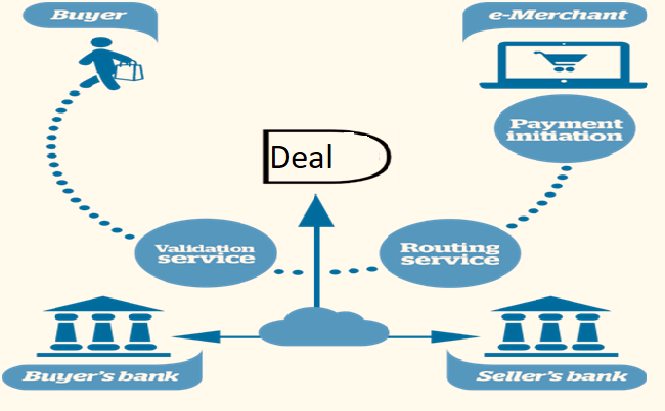

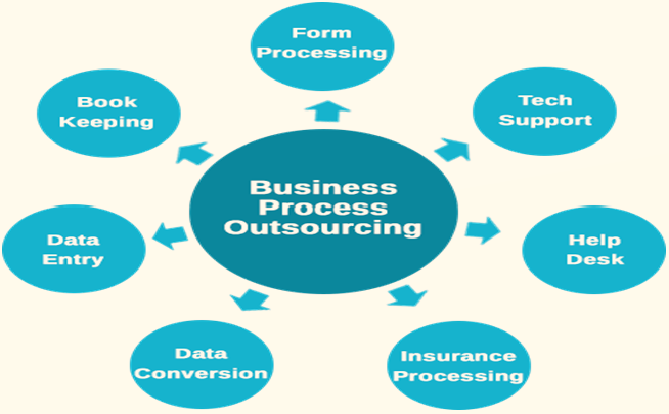

That’s why many big sites have outsourced payment processing to help prevent frauds. The additional expense is justified by the amount of money they save due to predictive analysis and prevention techniques. Outsourcing payment processing has not just helped in the prevention of frauds but also lowering down various other costs for a business. On the one hand, it is improving internal controls for an organization while on the other hand, it is also improving vendor relationships.

Professional payment processing companies have access to Big Data and the best Data Analytics algorithms that can predict and prevent payment frauds. To understand how this works, it is first prudent to know what are the different types of frauds are:

Jump to Section

Cards fraud

This is the most common kind of fraud that affects online E-Commerce sites. As the online retailers cannot see the credit cards physically, their systems are not designed to detect fake or stolen cards. Retailers do put in authentication measures like one-time-passwords (OTPs), mobile number or billing address verification, card verification value (CVV) which is a 3-digit number on the back of the card, etc. But these measures are not foolproof and an expert hacker can get this information very easily.

Return fraud

This has unfortunately been initiated by online retailers themselves by offering an easy return and full refund policy for some products. Fraudsters take advantage of this by using a product for a while and then either claiming they never received it or returning it saying it was damaged on receipt. E-Commerce sites are more susceptible to such frauds than shop sellers. They may have put in measures like confirmation of delivery, extra fees for returns, etc. but again, these methods have not been 100% successful in preventing frauds.

Identity theft

E-Commerce sites who have not outsourced their payment process are also vulnerable to identity theft. Hackers can steal the personal information of the clients that they had entered during the online transaction, like bank details, credit card numbers, mobile phone numbers (needed for the OTP), and other credentials. Online retailers have their own ways of tracking customer behavior, their preferences, their ordering patterns, shipping addresses, contact details, to try and eliminate identity fraud. But these measures haven’t shown 100% success in preventing frauds.

How Outsourced Payment Processing Helps to Prevent Frauds

When the payment processing of online retailers is outsourced to professionals, they use advanced Data Analytics tools to detect suspicious patterns in online transactions. Their algorithms are designed to track online payment activities, compare the fresh data with historical data and check for similarities with previous fraudulent transactions. Therefore, there is no doubt that pattern analysis is the key factor that outsourced payment processing companies use to detect fraud. The algorithms look for patterns in:

- A sudden large volume of purchases that do not fit into the behavioral pattern of that customer.

- Usage of a card that has been reported as stolen.

- Fake wire transfers.

- Insufficient balance while using the debit card online.

- Mismatch of personal information like mobile number and CVV.

The Business Intelligence algorithms employed by outsourced payment processing systems also look for recognizable attack patterns when fraudsters usually attack online retail sites. Some of them are:

Timing patterns

These activities are found to be most common during festival or marriage seasons when the volume of online business is very high. The tax-filing season is also a time when fraudsters can access personal details of online transactions. But the predictive analysis tools used by the outsourced payment processing companies are designed to anticipate and abort such activities before a fraud takes place.

Collaborative patterns

In some cases, apparently legitimate customers of the online retailer may be partnering with known criminals to attack online payment processing systems. Data Analytics tools are designed to track relationships between suspicious activities between two individual entities. The most common pattern is when purchases are made just below the credit limit of the customer. By tracking the history of such transactions, the algorithm can intelligently detect if a particular transaction is fraudulent.

Prevention of Fraud

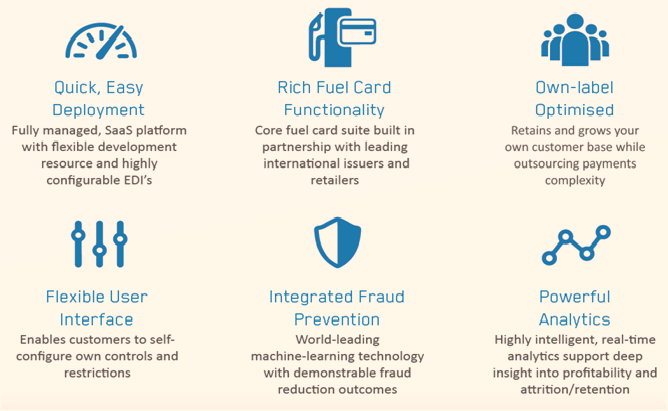

Data Analytics tools work very fast and provide solutions in seconds. The faster a fraud is detected, the better are the chances that it will be prevented in time. It has to be an instantaneous process so that there is no monetary loss. It is not possible to apprehend the crook because the person cannot be seen by the online retailer. So prevention is the only solution. The machine learning model employed by outsourced payment processing companies is capable of handling Big Data and millions of simultaneous transaction and prevent fraudulent ones at the same time.

Data analytics

Big Data is first categorized by the Data Analytics tools used by outsourced payment processing companies in order to analyze it. The algorithms are first tested against the full data to identify fraud patterns and to set the parameters that will form the rules for fraud detection. The machine learning model is also set to seek out new fraud patterns to add to the list of existing patterns. The algorithms must prevent or minimize false positive customer behaviors at the same time by speeding up the online payment process.

But how would a Data Analytics tool detect return fraud? For Artificial Intelligence nothing is impossible! The tool is already tracking customer behavior on social media networks. The tools also analyze images of products sold online with the full knowledge of all the major E-Commerce sites. When the social media images match the online retailer’s images but the customer claims not to have received the product or returns it claiming that it is damaged, it is an obvious case of return fraud.

Real-time detection

Real-time detection is another method used by outsourced payment processing companies. They track transaction patterns in real-time against existing data warehouses, preset fraud rules, card authorization patterns, etc. to not only detect frauds but to also prevent them before the transaction goes through. To do this, the machine learning model will use and analyze data streams simultaneously coming from the customer’s smartphone apps and its location, customer’s social media news feeds, purchase history, retailer’s weblogs, and other sources of Big Data to prevent fraudulent transactions.

As Artificial Intelligence tools can analyze historical data dating back to days, weeks, months, and even years, identifying fraud patterns in real-time is not a difficult task. The algorithms are capable of handling hundreds and thousands of fraud-detection parameters simultaneously to identify and prevent online payment frauds.

The DA algorithms are also designed to process streaming data by tracking movement and location of high-value products. This will tell the retailer when and where the product was delivered to the customer. This process is essential for preventing return frauds.

Behavior analysis tools

Behavior analysis is another major part of the fraud detection process that the DA tools of outsourced payment processing companies use. This involves a process of visually analyzing data to get insights even if the data is streaming in real-time from different geographical locations. The machine learning model will identify those regions, cities, localities, types of customers, usual products etc. that shows a high rate of fraudulent payments.

This helps the retailer to allocate money accordingly for fraud prevention. As the incidents of fraud reduce, the time spent in reviewing every order is minimized. The algorithm can accurately predict and graphically present the probability of fraud for each online transaction. The DA tool is usually designed to send instantaneous red-alerts by email and SMS to the retailer for probable escalation.

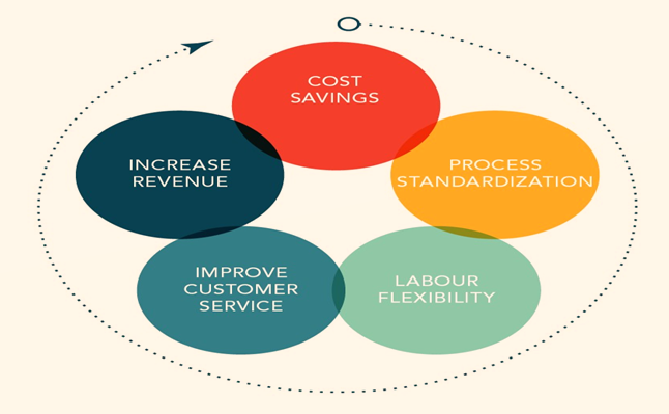

Advantages of outsourcing payment processing

- Cost reduction– switching from cash mode of payments to E- payments save time and money and by outsourcing it, human resources can be focused on other tasks and reduce the lead time.

- Increased Security– securing financial information internally requires more security and protocols and also place a burden on the finance department. There, by outsourcing it, the third party will secure all the financial information from cyber theft and reduce the burden and saves time.

- Lessened fraud risk– Outsourcing payment processing actually improves internal controls of the firm. Using a trusted third party provider keeps important financial tasks separated and therefore help reduce or eliminate fraud.

- Improved vendor relation– Streamlining the payment system means faster and more accurate payment processing. Since everyone’s happier when they get paid on time and without any hassle, that improves relationships with vendors.

- Flexible payment solutions– payment process called Next Process allows the company to keep the vendors in a payment loop so that the vendors will receive a clear notification about the next payment and makes them to choose the payment option that is suitable for them and monitor the status of the payment in real time.

Conclusion

Today, the customer relationship is not limited to just selling products and delivering them at the right place on time. Considering the fierce competition that online retailers have to face, getting an edge over one’s competitors by providing the best customer experience is vital for a business.

Customers are extremely sensitive about their financial information and personal details being misused by frauds. Therefore, part of the customer satisfaction process also involves the assurance that their online payment process is both secure and super-fast. This assurance also means a better conversion rate, more profits, long-term customer retention, and the creation of brand value for the retailer.

Therefore, more and more retailers and E-Commerce sites are using outsourced payment processing companies to help prevent frauds. Their machine learning tools have parameters that track patterns to detect probable frauds and to abort the transactions before money is lost.

- Business Intelligence Vs Data Analytics: What’s the Difference? - December 10, 2020

- Effective Ways Data Analytics Helps Improve Business Growth - July 28, 2020

- How the Automotive Industry is Benefitting From Web Scraping - July 23, 2020